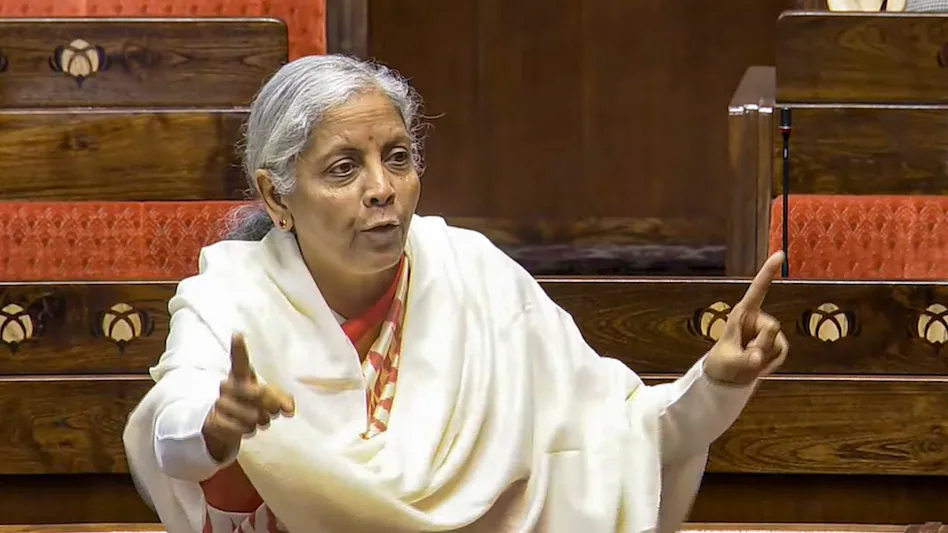

Fiinance Minister Nirmala Sitharaman has again assured the focus of the government to alleviate the financial burden on middle-class taxpayers by strategic tax reforms and support initiatives. While noting that salaried employees were facing challenges, she went on to mention the following major measures introduced in the last Union Budget: an increase in the standard deduction to ₹75,000 from ₹50,000.

Sitharaman said in an interview with Times Now that these measures, combined with changed tax rates, are intended to deliver incremental relief across the board across income brackets and benefit the middle and higher-income people. The government is said to be considering wider income tax cuts for individuals earning ₹15 lakh a year or less, which will affect millions of urban taxpayers who struggle with high cost of living.

Under the 2020 tax regime, incomes between ₹3 lakh and ₹15 lakh are currently taxed between 5% and 20%, while incomes above ₹15 lakh are taxed at 30%. The suggested changes are to make this taxation system more attractive, particularly for those who are not making use of exemptions such as housing rental benefits.

Other key initiatives proposed include taking interest for up to ₹10 lakh on student loans and enhanced benefits for affordable housing, which reflects the government’s commitment to holistic financial support for families.

These measures come amid economic headwinds, including slowed GDP growth—the weakest in seven quarters—and high food inflation, which has dampened consumer demand. The surge in taxpayers earning between ₹50 lakh and ₹1 crore over the last decade further underscores the growing financial burdens on both middle- and high-income groups.

As the government prepares the upcoming Budget, its priorities are clear: address taxpayer concerns, stimulate consumption, and implement targeted measures to navigate economic challenges effectively.

For more online business news visit https://newsnestify.com/